[ad_1]

I think this is a market that continues to attract a lot of value hunting going forward.

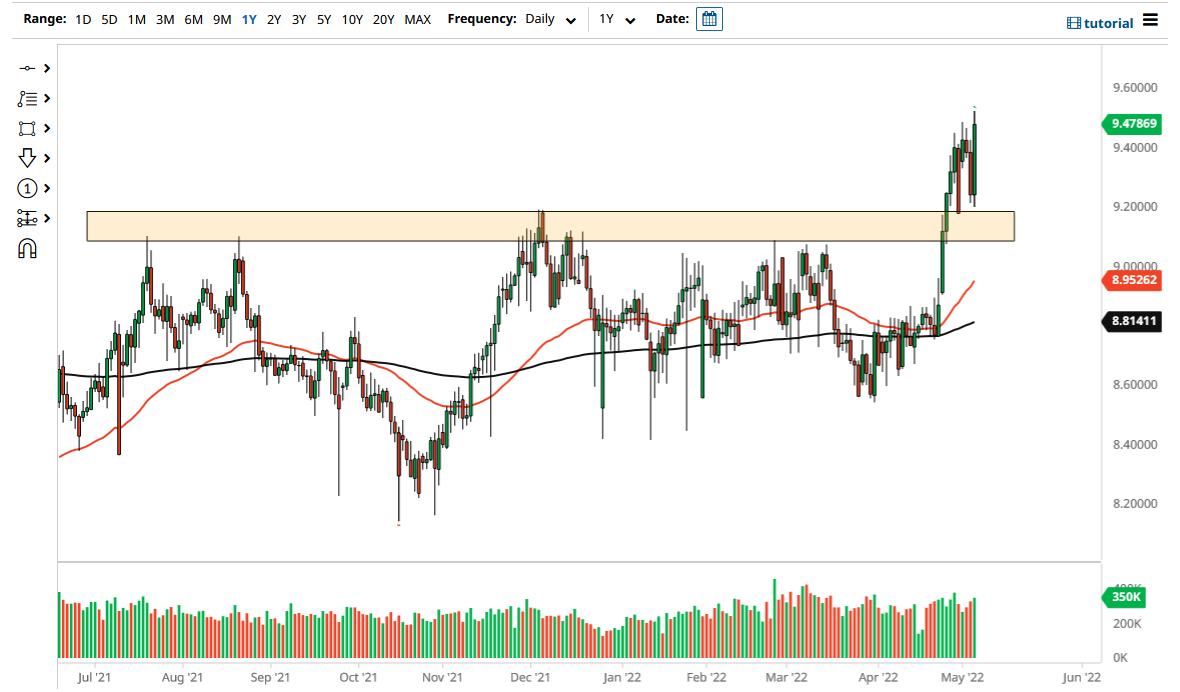

The US dollar has rallied rather significantly during the trading session on Thursday as the 9.2 level has offered significant support yet again. In the last couple of days, we have seen this area act as buying pressure, which makes sense considering that it had been previous resistance. Ultimately, this is a market that has a lot of influence coming from the crude oil market, but it also has a lot of influence from the Federal Reserve itself. After all, the Federal Reserve continues to show signs of tightening monetary policy, and after the statement and press conference on Wednesday, Jerome Powell made it clear that there will be 50 basis point rate hikes for the next couple of meetings.

The size of the candlestick is rather impressive, and it does suggest that we are going to go higher. The 9.5 level is an area that has a little bit of psychology attached to it, and if we can break above there then the US dollar is likely to continue reaching higher, perhaps going as high as the 10.0 NOK level. Short-term pullbacks will more likely than not continue to find plenty of value hunters, as long as we can stay above the 9.2 NOK region.

Furthermore, there is a bit of a “risk-off” type of attitude around the world, so the last thing that people will be looking to get involved in will be Scandinavian currencies instead of the US dollar. The US dollar is the first place people go to when they look for safety, and that will continue to be the case. In fact, I would even go so far as to say that we have much further to go based on what I am seeing in the US Dollar Index.

On the other hand, if we were to break down below the last couple of days, it is likely that the US dollar goes down to the 50 Day EMA. The 9.0 level is right there as well, and it should be psychological support. Breaking down below that level then opens up the possibility of a move down to the 200 Day EMA, which is at the 8.81 NOK level and rising. Either way, I think this is a market that continues to attract a lot of value hunting going forward.

[ad_2]