[ad_1]

I do not have any interest in shorting the US dollar right now, and certainly would not do so against Brazilian real.

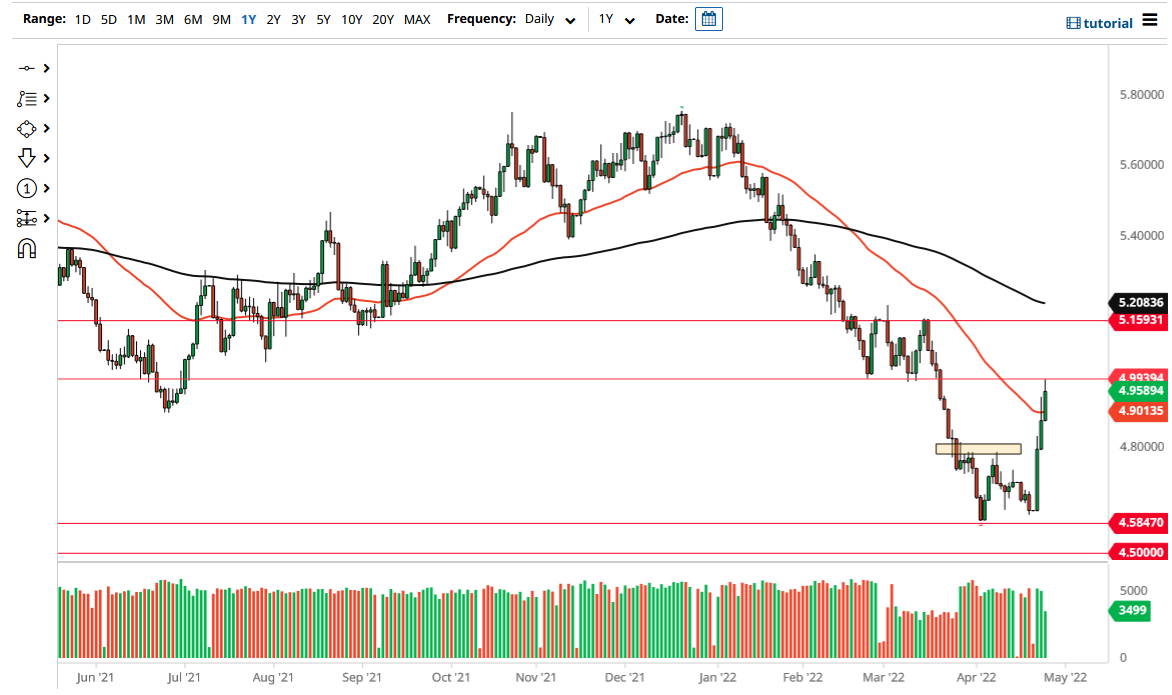

The US dollar rallied significantly to slam into previous support, which should be resistance, against the Brazilian real. The area between the 5.00 and 5.15 levels continues to be of interest, as we had consolidated in that general vicinity previously. As we slammed into the bottom of it during the trading session on Tuesday, we finally ran out of a little bit of momentum, which has exploded in favor of the greenback over the last several days.

Latin American currencies can give great price movements.

Trade them with our featured broker.

Trade Now !

At this point, the market looks as if it is going to try to reenter that consolidation area, but I would anticipate a big fight. After all, we have gone straight up in the air for three days, and although it is a very bullish sign, eventually you will get a pullback. That being said, the pullback could very well be a nice buying opportunity if we get some type of support candle. The 4.80 level should be supportive now that we have broken above it, based upon “market memory.”

I do believe that as long as there is going to be a lot of fear out there, it makes sense to consider that the US dollar should continue to throttle emerging market currencies such as the Brazilian real. In fact, emerging market currencies are some of the worst-performing out there right now, because so much of the emerging market debt is priced in US dollars. The stronger the US dollar gets, the less attractive the emerging market currencies become.

Commodity markets have underperformed as of late as well, so keep an eye on that although it is a bit of a mixed bag. The markets will more likely than not continue to see a lot of choppy volatility, so you need to be very cautious about how you put money to work. I think simply waiting for some type of pullback that shows signs of support is the best way to go, or if we can break above the 5.00 level. I do not have any interest in shorting the US dollar right now, and certainly would not do so against Brazilian real. Yes, I recognize that we are still technically in a downtrend but the US dollar can be like a wrecking ball against everything when it wants to.

[ad_2]