[ad_1]

There are a lot of “buy on the dip” buyers out there waiting to jump all over any type of value that they see in the US dollar,

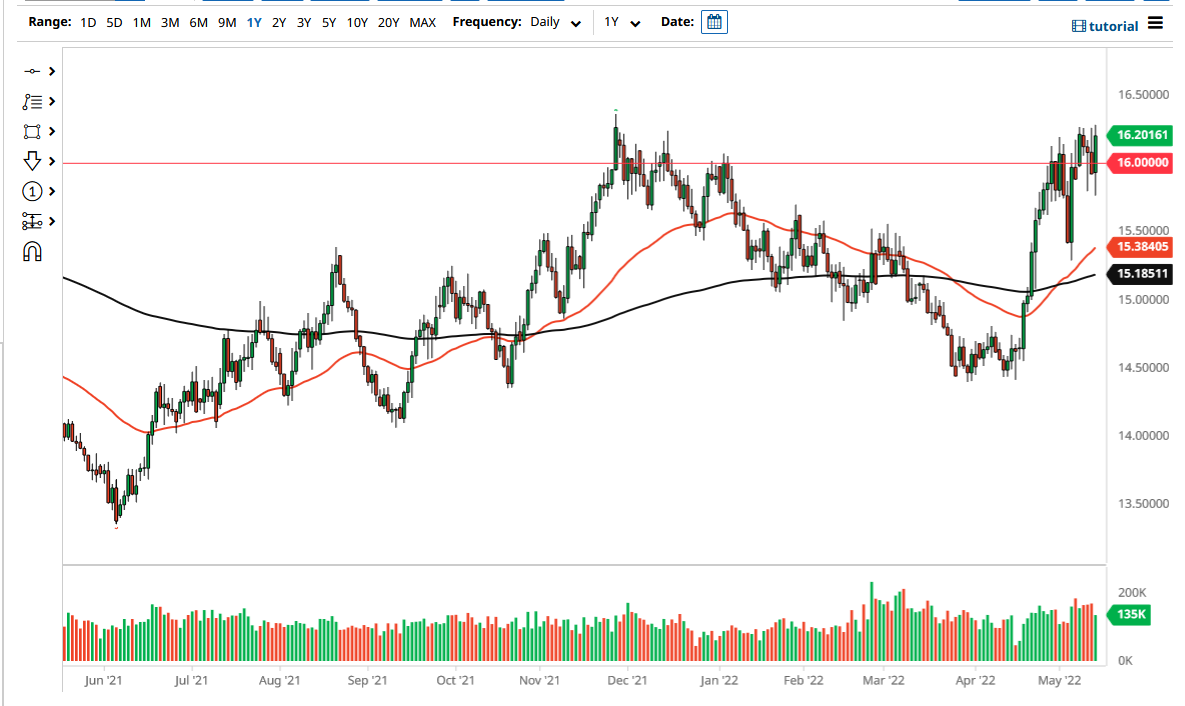

The US dollar initially pulled back against the South African Rand during the trading session on Friday but found support near the 15.75 Rand level to turn things around. At that point, the market broke above the 16 Rand level, and even threatened the 16.20 level before it was all said and done. Keep in mind that the South African Rand is most certainly a “risk-on” type of currency, and in the environment that we have been in for quite some time, it does make a certain amount of sense that people may run away from it.

Furthermore, commodities continue to be threatened, and the South African economy is highly levered to hard assets such as gold and other minerals. If we can break above the 16.25 level, then it is likely that we could continue to see a lot of momentum come into the picture, perhaps opening up a move to the 16.50 level. Pullbacks at this point should see plenty of buyers, and the realm of value hunting. Even if we break it down below there, it is likely that the market could go looking to the 15.50 Rand level, where the 50 Day EMA is currently reaching. The 50 Day EMA broke above the 200 Day EMA recently, forming the so-called “golden cross.” This is a market that continues to see a lot of noisy behavior, but that is nothing new for this pair.

I believe there are a lot of “buy on the dip” buyers out there waiting to jump all over any type of value that they see in the US dollar, and as long as there is a general shunning of risk appetite, most specifically emerging markets, South Africa will not be a place that people are willing to throw a lot of money at. In fact, it is not until we break down below the 200 Day EMA that I would be short of this pair. The 15 Rand level sits just below there, which has a lot of psychology attached to it as it is a large, round, psychologically significant figure. All things being equal, you can see where buyers have stepped in every time there has been a bit of a pullback as value hunters are willing to take advantage of greenbacks every time they get “cheap.”

[ad_2]