[ad_1]

Start the week of April 11, 2022 with our Forex forecast focusing on major currency pairs here.

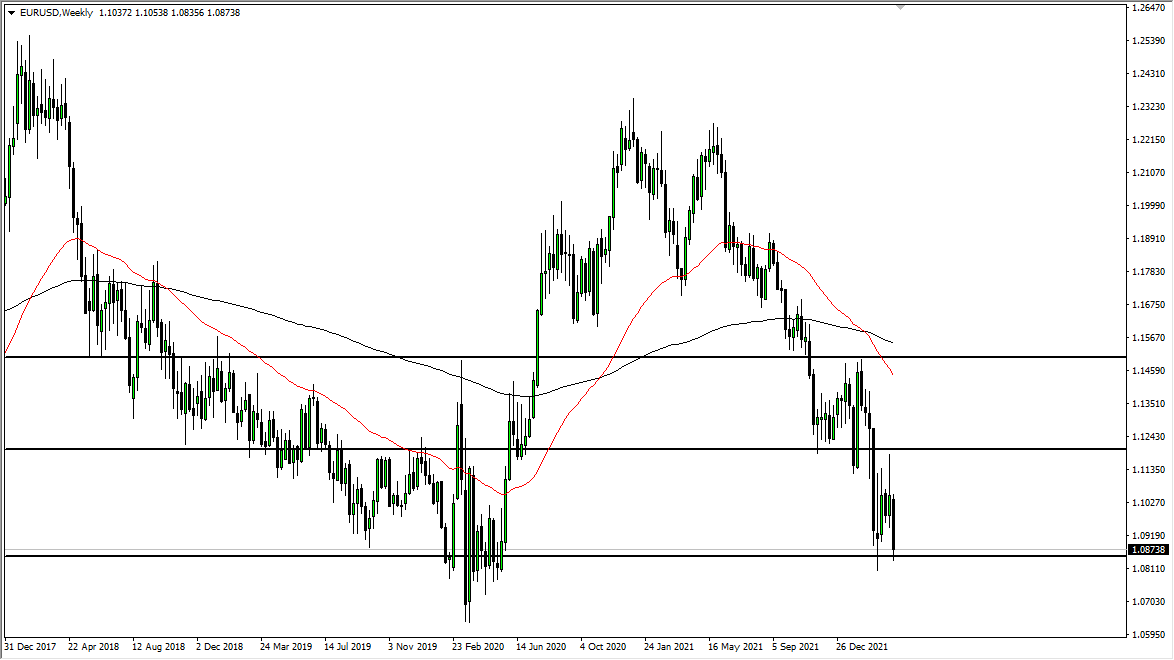

EUR/USD

The euro fell significantly last week to crash into the previous support level near the 1.0850 area. At this point, the market looks as if it is trying to break down, but it should be noted that this is an area that has shown a bit of support recently. Because of this, we could get a bit of a bounce, but I think a bounce will more likely than not end up being a massive selling opportunity. I would look for signs of exhaustion to start shorting on any value offered in the US dollar. The euro has a whole host of issues working against it currently.

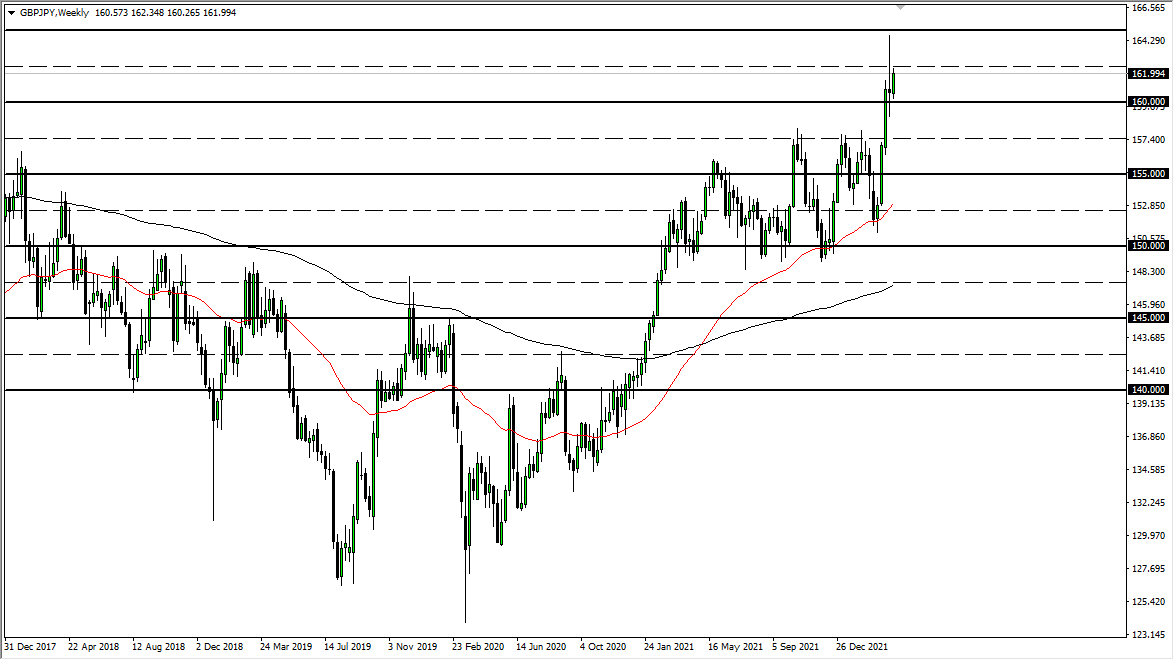

GBP/JPY

The British pound rallied against the Japanese yen quite significantly during the trading week, reaching the ¥162 level. This is an area that could offer a little bit of resistance, and it should be noted that the market is overextended. The previous week was a massive shooting star, so it will be interesting to see if we can break above there. If we can, then it would obviously be very bullish. However, the market certainly looks as if it is struggling at this point. Of special note this week will be the ¥160 level.

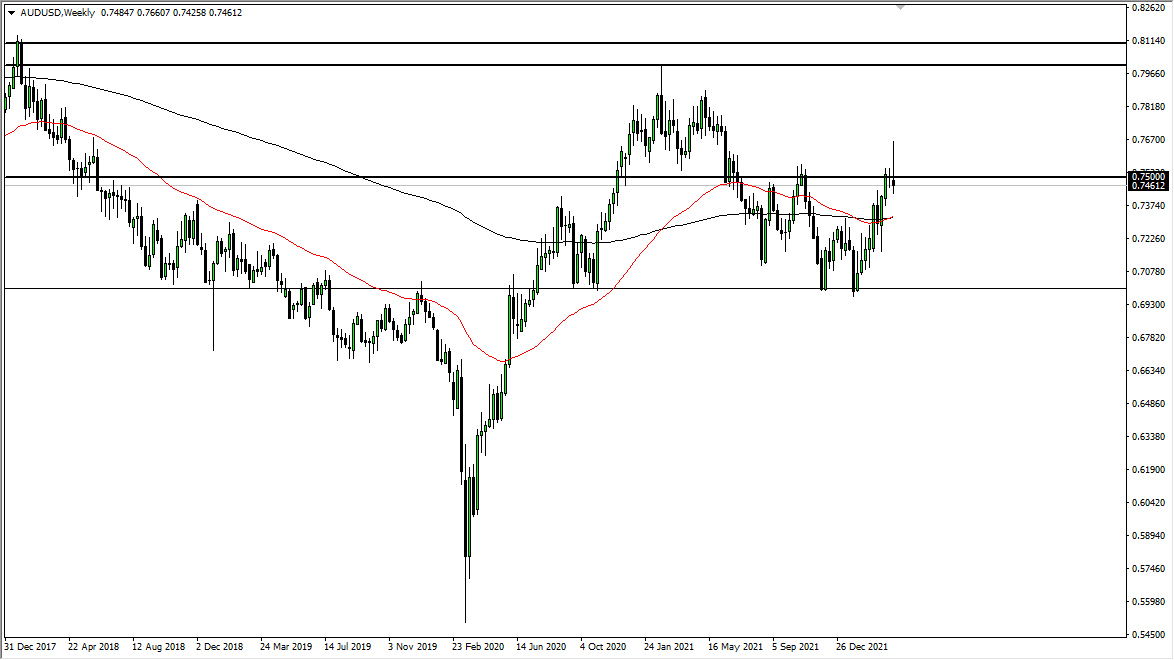

AUD/USD

The Australian dollar initially rallied during the week but gave back the gains to show signs of hesitation. The RBA initially shocked the market to the upside by dropping the word “patience” from the statement, thereby having people think that they were closer to raising rates. However, the FOMC minutes released were very hawkish, and we started to see money flow back into the US dollar. With that in mind, it does make a certain amount of sense that we have formed this massive shooting star right at a resistance barrier. I suspect we could very well pull back further from here.

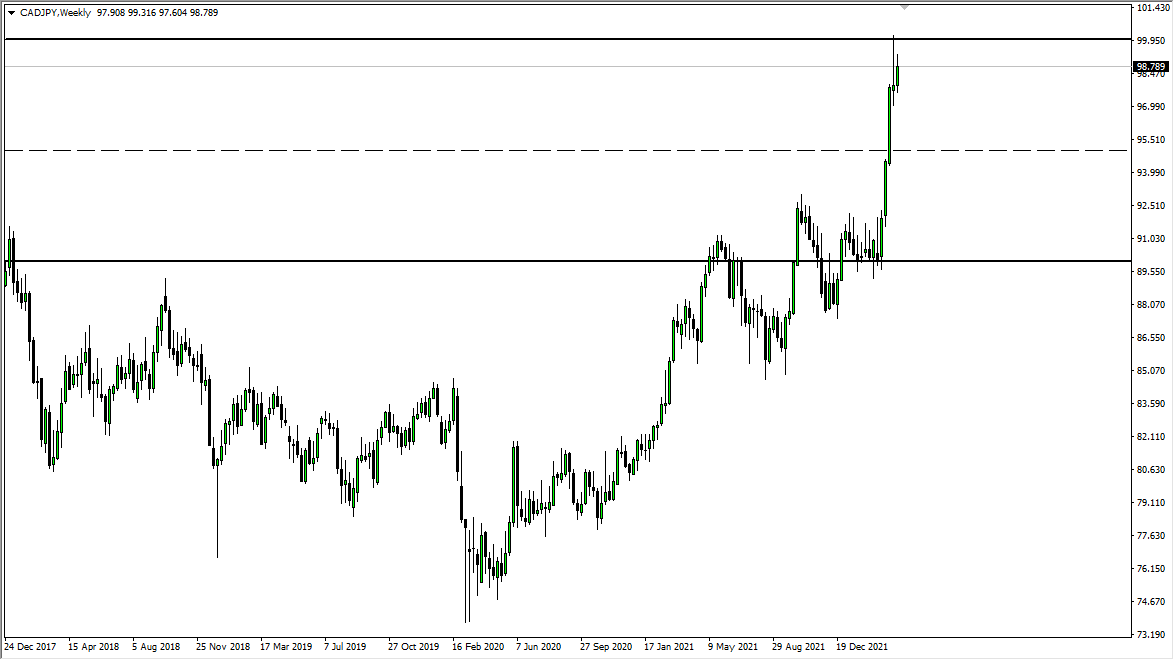

CAD/JPY

The Canadian dollar rallied again against the Japanese yen last week, but it now looks as if the area above, especially near the ¥100 level, is going to face a major amount of selling pressure. That being said, if we were to break above the ¥100 level, it could open up the Canadian dollar to rally to the ¥102 level, possibly even higher than that. Pay close attention to the oil market, as that could come into play as well.

[ad_2]