[ad_1]

Gold can be bought from every bearish level.

The price of gold extends its gains with the weakness of the US dollar index DXY, and mixed Treasury yields as markets start in August in the red. The price of XAU/USD gold moved towards the resistance level of 1775 dollars for an ounce, the closest point to the psychological resistance of 1800 dollars an ounce. All in all, gold prices are looking to extend their gains after posting a weekly gain of 4% last week. Coinciding with a weak US dollar, mixed Treasury yields, and a drop in stocks, this could be a major opportunity for the precious metal.

Despite the strong weekly consolidation, the price of gold fell 2% in July and is down about 3% YTD 2022. In the same way the price of silver, the sister commodity to gold, is also trying to keep the winning streak alive. The price of silver rose to 20,265 dollars an ounce. Overall, the white metal enjoyed a 10% increase last week and a 2% monthly jump. However, silver prices are still down more than 13% YTD 2022.

Metal commodities are benefiting from so-called Fed pressure. This means that gold and silver could rise in the direction of the US central bank, which is likely to pivot in tightening efforts. Next year, Federal Reserve Chairman Jerome Powell may slow down the pace of US interest rate hikes and may cut rates to support economic growth in late 2023. Analysts also note that gold and silver jumped on money managers who covered their short positions after initiating a net sell for the first time since 2019.

Commenting on this, Daniel Ghaly, commodities analyst at TD Securities, told MarketWatch: “Money managers cover short positions across gold and silver, but in gold you have another group taking the other side, while in silver it is not.”

All in all, industry watchers note that gold and silver are in oversold territory, so it is possible that the two metals could regain some lost ground. Meanwhile, the metals market is also climbing with lower gains and a declining bond market. Take a look at the drivers of the gold market. The US Dollar Index (DXY), which measures the performance of the US currency against a basket of currencies, fell to 105.51, from an opening at 105.90. The index fell more than 1% last week but rose about 0.4% in July. And from the beginning of 2022 to date, the US index is still up by about 10%.

A lower exchange rate is a good thing for dollar-priced goods because it makes them cheaper to buy for foreign investors.

What else affects the gold market?

The US Treasury market was mostly mixed as the week’s trading opened, with the benchmark 10-year bond yield dropping 1.3 basis points to 2.629%. One-year bond yields were flat, while the 30-year bond yield was also unchanged. Lower Treasury yields are bullish for gold because they reduce the opportunity cost of holding non-yielding bullion.

In addition, the spread between the two-year and 10-year returns is still hovering around -27 basis points.

For other metals, copper futures fell to $3.5375 a pound. Platinum futures were up $11.30, or 1.27%, to $901.10 an ounce. Palladium futures advanced to reach $2,177.50 an ounce.

Today’s XAU/USD Gold Price Forecast:

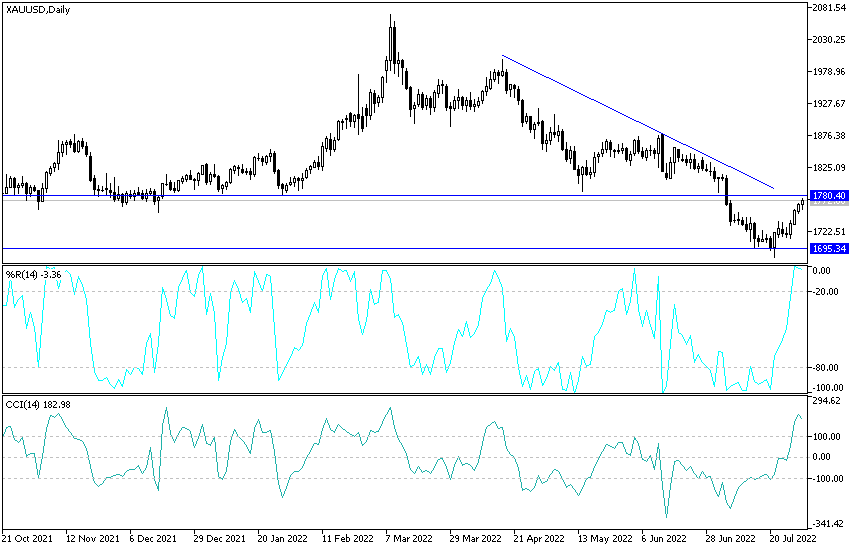

On the daily chart below, the recent gold price gains contributed to breaking the bearish trend, and the shift will be to the upside if the XAU/USD price tests the psychological resistance level of $1800 an ounce. We expect that the stability of the gold price above the resistance level of 1780 dollars an ounce will support the move to that psychological resistance. Global geopolitical tensions, as I mentioned before, may remain supportive of the gold market despite the tightening trend of global central banks.

As I recommended before, gold can be bought from every bearish level. The closest support levels for gold are currently 1758 and 1740 dollars, respectively. The movement may remain in narrow ranges until the release of the US jobs numbers by the end of the week.

Ready to trade today’s Gold prediction? Here’s a list of some of the best Gold brokers to check out.

[ad_2]