[ad_1]

If the world is heading into a global recession, it is hard to believe that crude oil will have a strong move in the long term.

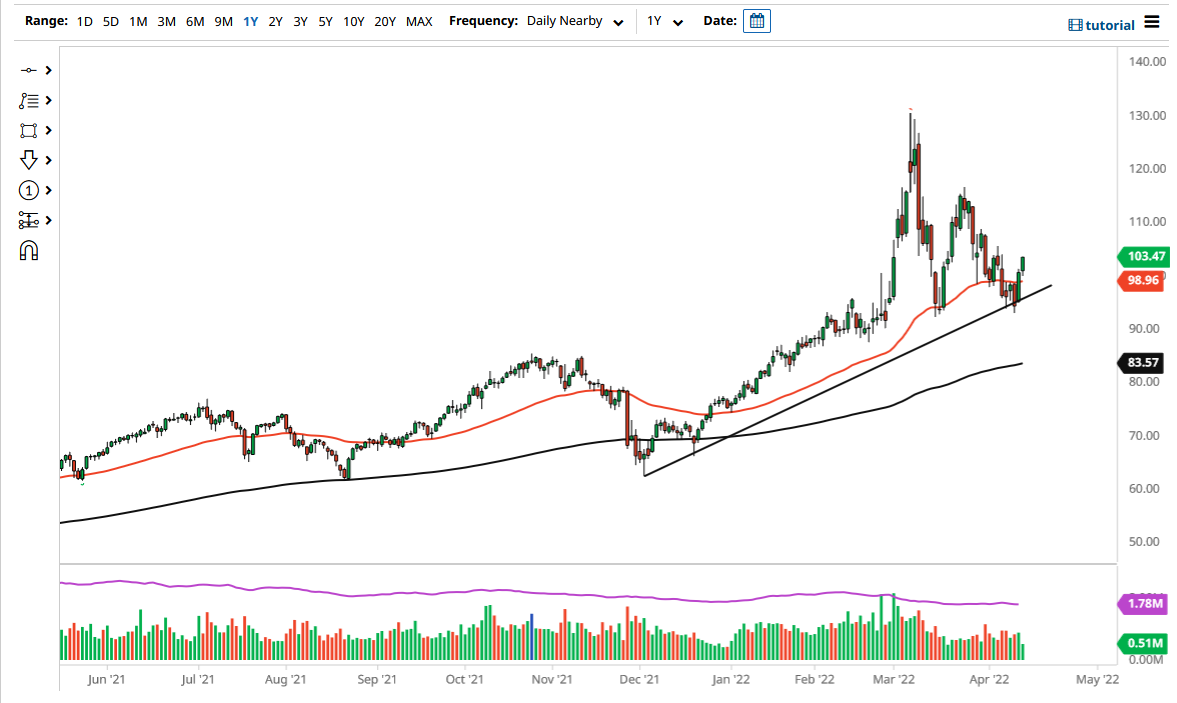

The West Texas Intermediate Crude Oil market rallied on Wednesday as we continue to recover overall. The uptrend line is an area that a lot of people will pay attention to, as it has been so profound down for so long. The 50-day EMA is sitting right in the same area, where the market had bounced from. The candlestick on Tuesday was very bullish, but what was interesting is that the market continued despite the fact that inventory numbers did not necessarily suggest that we should see that.

A lot of this is going to come down to risk appetite and whether or not the demand for crude oil will continue to pick up. After all, the global slowdown that is almost certainly coming is going to be a situation that should drive down demand. Having said that, the $105 level above could be a little bit of resistance. If we can break above there, then it is likely that we could continue to go higher, perhaps reaching the $107.50 level.

On the other hand, if we break down below the 50-day EMA, then it is likely that we will go looking to the uptrend line again. When you look at the structure over the last several weeks, you can see that we have had a lot of damage done to this market, and it is worth paying attention to the very real possibility that we have seen the highs in the market from the longer-term standpoint. After all, if the world is heading into a global recession, it is hard to believe that crude oil will have a strong move in the long term.

If we were to break down below the uptrend line, then I think the market will go looking toward the $90 level. The $90 level is an area that has been important more than once, so it is very likely that we would see a certain amount of support in that area. If we were to break down below the $90 level, this thing would come undone. I do not see that happening anytime soon, especially after the nice recovery we have had over the last 48 hours. Pay attention to the US dollar, because that could also come into the mix as well.

[ad_2]