[ad_1]

This is a market that I am still bearish on, but I need to see a bit of a bounce before putting money to work.

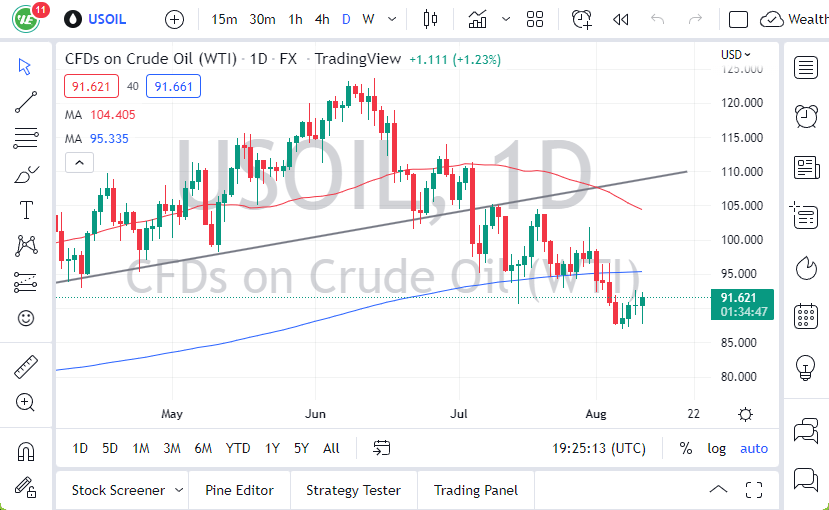

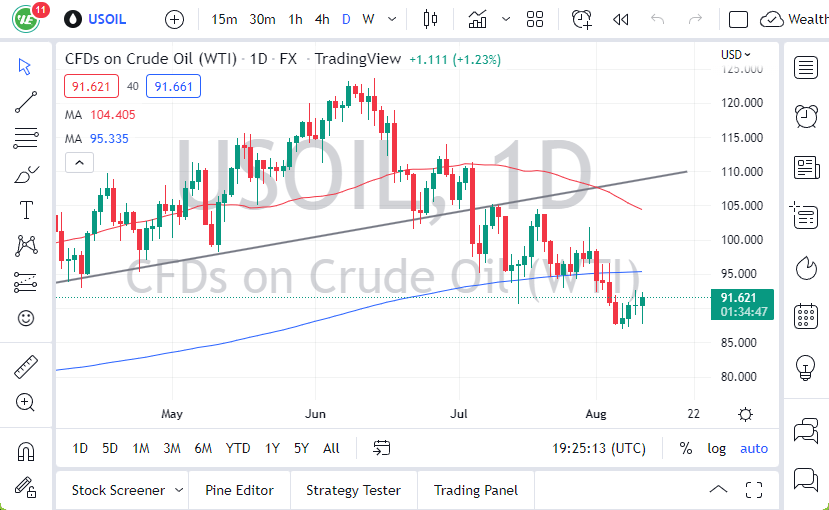

- The West Texas Intermediate Crude Oil market pulled back initially on Wednesday to test the lows yet again.

- That being said, we have turned around to show signs of life, perhaps due to the idea of more risk-taking out there as the CPI numbers came out cooler than anticipated.

- The idea is that the Federal Reserve will not have to slow down the economy as much as one side, and that could lead to more demand for crude oil.

Rough Road Ahead

I’d be remiss if I did not push back on this idea, because quite frankly inflation is over three times what the Federal Reserve is comfortable with. In other words, although the CPI number was cooler than anticipated, the reality is that it is still far too high for the Federal Reserve to pivot. In other words, they are going to engineer a recession, although it doesn’t necessarily seem that they are going to have to try very hard as various indicators showed just how out of sync this economy is in the United States. As long as that’s going to be the case, then oil has a rough road ahead.

The 200-day EMA sits just above the $95 level, and I think that could offer quite a bit of resistance. I would be very interested in shorting this market on a negative candlestick, but we don’t have that set up yet, and I think at this point you need to look at this through the prism of a downtrend that has been in a nice channel for a while. We are simply in the middle of that channel, and I think at this point in time it’s very likely that we will continue to see sellers above. We don’t necessarily have that right now, but I think after a little bit of a bounce, it’s very likely that they will return, especially near the $95 level.

If we break down below the bottom of the candlestick for the trading session on Wednesday, that could open up quite a bit of selling pressure, sending the market down to the $85 level, possibly even the $80 level. Ultimately, this is a market that I am still bearish on, but I need to see a bit of a bounce before putting money to work.

Ready to trade our WTI Crude Oil Forex? We’ve made a list of the best Forex Oil trading platforms worth trading with.

[ad_2]