[ad_1]

The more volatility, the more likely we are to pull back.

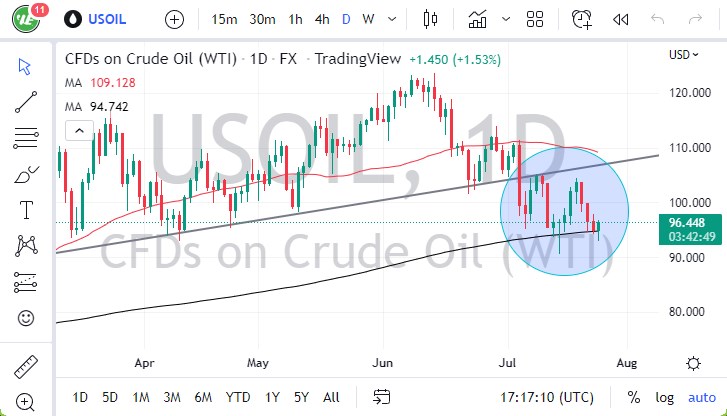

- The West Texas Intermediate Crude Oil market initially fell on Monday to break through the 200-day EMA, which is a rather negative turn of events.

- By breaking through there, it causes quite a bit of volatility to pick up, due to the fact that the algorithms that drive many CTA accounts become bearish at that point.

- However, when we jump back over the moving average, it causes yet another flip.

- Looking at the shape of the candlestick, it looks as if we are trying to turn things around, perhaps using the 200-day EMA as a potential support level.

Multiple Resistance Barriers

That being said, the market still has a lot to deal with above, as there are multiple resistance barriers. The first one would be the $100 level due to the psychology of that figure. That being said, we have sliced through their multiple times, so it does suggest that there could be a bit of a reaction, but it may also be somewhat limited. After that, we have seen the $104 level follows quite a bit of resistance, so I do think that there could be a lot of resistance there as well.

Above that area, we have the previous uptrend line that should have a bit of “market memory” attached to it, especially with the 50-day EMA sitting right around the $110 level. Looking at this chart, it’s obvious that the market will continue to be very noisy, and that typically favors the downside more than anything else. If we do break down from here, it’s possible that we could break below quite a bit of support. The $90 level underneath is the most recent low that we have tested, as we had formed a massive hammer.

If we break down below the bottom of that hammer, it would be a very negative turn of events. At that point, it’s likely that we would see a move down to the $80 level, and therefore it does make a certain amount of sense that momentum would start to pick up at that point. Pay close attention to the OVX, which is the Oil Volatility Index, as it can give you a bit of a “heads up” as to where we could go next. The more volatility, the more likely we are to pull back.

Ready to trade WTI/USD? Here are the best Oil trading brokers to choose from.

[ad_2]